What is an appraisal?

Whether you are buying or selling a home, learn more about what an appraisal is and what it is used for.

What is an appraisal?

An appraisal is an expert opinion of value given by a licensed appraiser. This report gives a detailed assessment of the property including its features and updates. These are weighed against similar homes which have recently sold or are actively for sale in close proximity and time to determine the home's worth to a consumer.

When is it used?

Appraisals can be ordered for a variety of purposes. Homeowners can obtain one on their own accords for informational purposes, but often they are obtained in order to secure financing (such as a loan to purchase or build a home). Lenders will sometimes require that the home's value be at least a certain percentage of the purchase price in order to secure the loan (this is called the loan-to-value ratio or LTV).

For example, if a buyer is purchasing a home, the financial institution may require that the home appraises for 100%, of the price in order to secure a loan against it. This would mean the home would need to appraise for at least the purchase price, if not more. In circumstances where the value is insufficient, the buyer may want riders attached to the contract to purchase to protect them. You can read more about what to do when an appraisal is "short" below.

How is the value determined?

When conducting their report, the appraiser will walk the property (which is called the subject), take photos, interview the homeowner or realtor, and measure the site. They will capture all of this data to weigh the subject against other properties which have recently sold or are actively for sale within close proximity and are of similar standard.

There are some driving principles that guide an appraiser to determine a home's value which include:

- Supply and Demand - The more demand there is for a particular property or the less supply that exists, the more valuable it is to consumers. For example, if there are not many homes available to the public at any given time in one area, but the demand to live there is high, the price may be inflated above what is typical.

- Utility or Usefulness - The more desirable features there are, the more it appeals to the market. For example, a three-bedroom house is more useful to more consumers than a one or two-bedroom house.

- Site or Location – The unique attractiveness of a property’s location is a major determinant of the other economic characteristics. For example, a property located next to a sewage plant may be less desirable than one next to a park. Or a property on a corner lot may be more desirable than one located on a busy street.

Keeping these principles in mind, the appraisal will determine the value by weighing whether a home of similar quality and features could be reasonably purchased in the nearby area for the suggested purchase price.

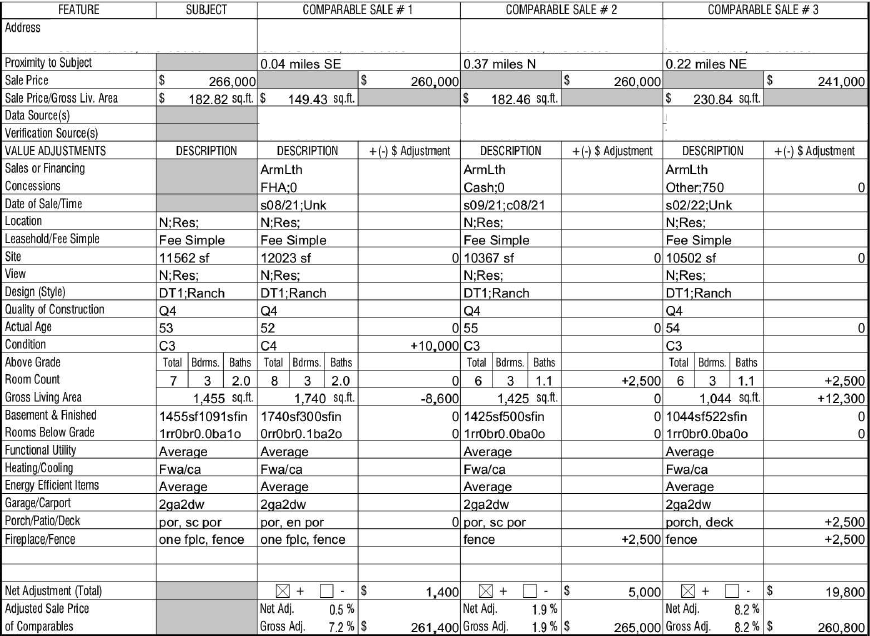

To do so they will compile a list of properties (called comparables) in the area they feel are most similar to the subject (typically 3-6 homes) and calculate the differences between the subject and the comparable homes. These differences will be called adjustments and will show the positives and negatives between the subject and other comparable homes.

With all that information in mind, an appraiser's chart of comparison will look something like this:

Note that these adjustments should not be used for all properties as an industry standard, but simply as an example of potential adjustments an appraiser might make.

The rest of the appraisal will detail the appraiser's remarks about the area, other notable features of the home, their research on the area supply and demand, why they chose the comparables they did, etc.

What if the appraisal is "short"?

Consequences to the buyer or seller:

An appraisal is considered "short" when the appraisal cannot prove a sufficient value for the purpose it is being ordered for. For instance, if the lender needs the value to return at $200,000 and the appraisal returns showing that the value is $190,000, then the appraisal is "short" or under by $10,000. What happens with this deficit is determined by the sales contract. If the buyer doesn't have any protections afforded to them in the contract, then the buyer will either be responsible for this deficit by means of cash, will have to find another method of financing the home, or will be unable to continue with the purchase of the home (which may mean they owe certain fees such as the cost of the appraisal or forfeit their earnest money).

If the buyer so chooses, they can enter into a contract with an appraisal rider, meaning they are protected from their responsibility to cover the deficit. In these cases, the seller will be responsible to lower the purchase price and the buyer may not be responsible for certain fees (such as forfeiting their earnest money).

Disputing the value:

The buyer, seller, or either of their agents, can also dispute the value of the appraisal with the appraiser. The appraiser, in fact, works independently of the lender and is not typically employed by the lender themselves. The lender will usually have a preferred list of appraisers which they will randomly select from to conduct appraisals on properties without bias. Since the lender must use the appraiser's opinion of value without bias, they will likely not order an additional appraisal in most circumstances.

However, the appraiser themselves may be able to be swayed into another opinion if they are given sufficient evidence. It's important to note that they are under no obligation to do so and it is not always possible to sway an appraiser. If one would attempt to do so, it would be best to provide that appraiser with new information or corrections to the information that was given in the appraisal. For instance, a new comparable home they did not consider, updates to the property which was not noted, or a correction to a purchase price.